|

|

| Events Jobs Contact Migration Stats Supplier Lists Municipal Aggregation |

|

Retail Providers Can Earn 3-4X More from Customers by Bundling Solar, Versus Commodity Supply Alone

June 10,2014 The following is a contributed article authored by Sierra Peterson, Director of Business Development for Clean Power Finance. Any views expressed in the article are solely those of the author, and not necessarily those of RetailEnergyX.com. RetailEnergyX.com disclaims any responsibility for the content of the article and makes no averment as to its accuracy or statements

Considering the Solar Opportunity? Four Things REPs Should Know -- Sierra Peterson, Director, Business Development, Clean Power Finance Halfway into the most difficult year for energy suppliers in recent memory, it's time to take stock. We've seen once-in-a-decade price spikes, startling market exits, both planned and forced, and regulatory disappointments as markets have chosen to delay and discourage competition. Retail customers have fled the market by the thousands: between December 2013 and April 2014, 90,000 Connecticut and Pennsylvania residential customers left their retail supplier. While Q1 revenues were up, margins were down: record pass-through power prices alienated many customers, setting retailers up for a difficult few quarters to come. What's ahead? More of the same, starting with compressed margins. Default service rates have evaporated the headroom for many retail suppliers. That, combined with wholesale price stabilization but fewer customers, means REPs face a tough numbers game. With no new retail territories expected to open within the next few years, competition will only intensify, particularly as new retailers enter the market. Growth will continue to be a zero-sum function of competition for the same pool of residential customers. The residential customer pool is shrinking as discouraged retail customers return to default service. In many markets, municipal-aggregation-driven switching has slowed, curbing customer entry into the competitive market. The polar vortex exacerbated retail flight in a number of markets: discouraged by their experience with pass-through pricing, customers bolted for default service by the tens of thousands. Publicly-held retail supplier Crius lost nearly 5 percent of its residential customer base in the first quarter of 2014, and margins slid markedly on Q1 2014 revenues that were up 50 percent from Q1 2013. As wholesale prices stabilize heading into spring, Crius must find, and keep, more customers to avert a precipitous decline in quarter-on-quarter revenue. Crius is not alone in the strategic imperative to address price-driven residential customer flight: a few retailer suppliers, Clean Currents among them, did not survive the winter of 2014. Polar vortex-driven customer flight accelerated and exacerbated a larger decline in residential retail power sales. After seven years of steady growth in residential retail sales, DNV GL predicts sales will flatten and wane in 2014. While DNV has yet to publish the most recent figures that quantify flight due to the polar vortex, forthcoming numbers on residential market decline are likely to be even more sobering.

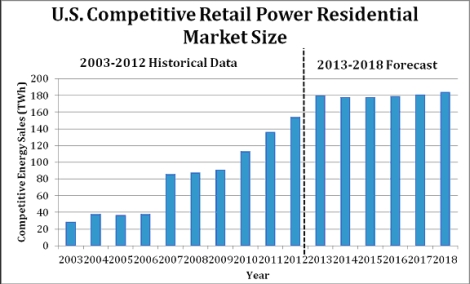

Source: DNV GL Retail Energy Markets' "Retail Energy Outlook" – December 2013. Note: DNV GL will be releasing their latest competitive power market forecasts in mid-June, 2014. Given these headwinds, many retailers are renewing focus on customer engagement to remain competitive. Over the past twelve months, new partnerships and services have enabled a few REPs to differentiate themselves in a commodity market. Crius and North American Power have announced residential solar partnerships; Crius with SolarCity and North American Power with Clean Power Finance. A significant majority of REPs recently polled by DNV GL confirmed their exploration of strategic alliances; we expect to see more solar partnerships in the near future. Structured wisely, such partnerships can also be a means to create more value from the retail customer relationship, boosting margins and extending the tenor of the relationship. Structured poorly, partnerships can expedite the erosion of a retailer's customer base, diminish the power of a retailer's brand, and prevent the retailer's future sales of retail power and other strategic products. As many REPs explore partnerships over the course of the next weeks and months, the following four points can serve as a strategic guide to residential solar. 1. Triple the Value of Customer Relationships 2. Seek Solar Expertise and Scale 3. Defend Your Brand A REP should defend its investment in its customer relationships by seeking a solar sales partnership that bolsters, rather than undermines, its brand. The ideal solar partnership will reinforce the retailer's relationship with its customers, positioning the REP as the customer's trusted source for additional energy and home services. 4. Consider Opportunity Costs REPs should also consider the longer-term potential to own the solar asset, creating an exclusive branded customer relationship of 20 years. Perhaps obviously, the expected lifetime value of a 20-year customer relationship is nearly 10x that of a standard retail customer, even without factoring in the profits from assumed future sales of home energy services and other strategic products. In many scenarios, this is a longer-term goal, and one that sufficiently well-capitalized retailers should keep in mind when exploring near-term solar sales structures. In a tough market, the outlook for many REPs remains uncertain. Those that build lucrative solar partnerships that diversify their branded product offerings and enable more profitable customer relationships will find themselves on surer footing throughout the coming year.

|

Advertise here: Email retailenergyx@gmail.com |

|

Home |

Developed by: Avidweb Technologies inc. |